Since 2005, E.Via has been specializing in the assessment of claims, primarily in the field of private liability insurance. In total, more than 200,000 claims have been reviewed.

Insurance fraud is a daily occurrence and is uncovered by our employees every day.

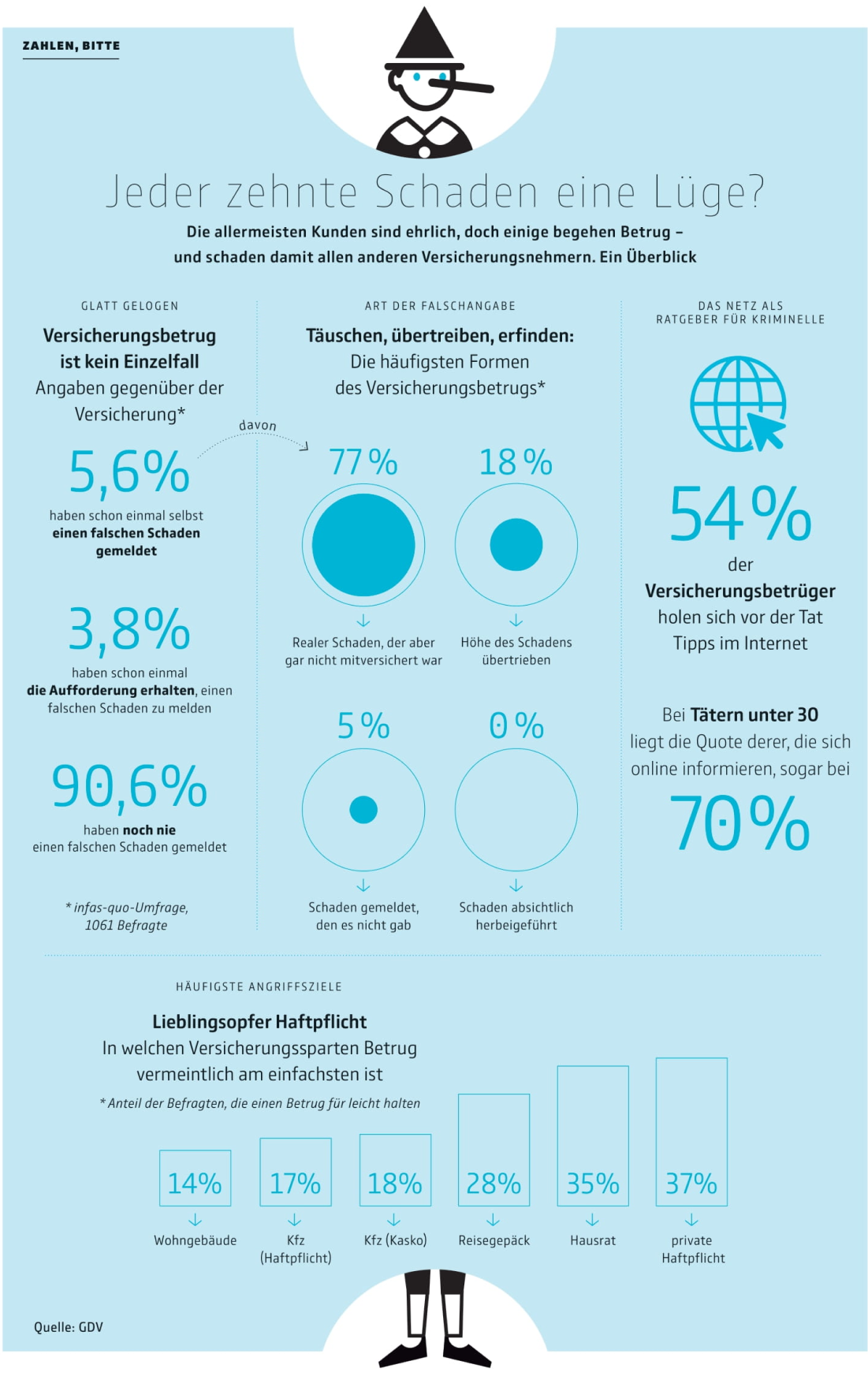

In August 2020, Der Tagesspiegel reported, citing data from the GDV, that the resulting damage amounts to €5 billion per year. According to a GDV survey (see image), one in ten claims is fraudulent. The results of our assessments show that these figures are in some cases significantly exceeded.

In 2015, FAZ examined various studies on the psychology of insurance fraud. The findings of economists Vanessa Köneke, Detlef Fetchenhauer, and Horst Müller-Peters, published in their book Understanding and Preventing Insurance Fraud, can be summarized as follows:

Young people are more likely to attempt fraud. The insurance industry has a poor reputation, which makes fraud easier to justify. Insurance fraud is hardly perceived as unfair, since the resulting damage is abstract to the perpetrator.

The researchers advise insurers to record claims quickly, leaving little time for second thoughts. As demonstrated by E.Via’s identified “inactive rate,” it is often sufficient to indicate that a claim will undergo a thorough review.

The analysis of several thousand claims and their backgrounds has shown that there are various reasons for potential fraud in liability insurance. These factors differ across the different device categories that were reviewed. The points listed here are taken from the evaluation of reported claims related to damaged smartphones.

The evaluation of damage descriptions compared to the actual damage shows that the inhibition threshold for attempted fraud is low.

Claimants give little thought to the consequences and are often unaware that attempted fraud is not a minor offense.

Insurers are perceived as wealthy. E.Via regularly receives statements regarding rejected claims in which claimants openly express that they find the rejection “unfair,” arguing that they have already “paid into” the insurance for many years.

A large proportion of devices involved in claims are financed. Often, the funds for purchasing the devices are already lacking, due in part to very high purchase prices. Ten years ago, a mobile phone cost around €300, whereas today’s top models cost well over €1,000. Repair costs have also risen significantly, as individual parts such as display glass are no longer replaced, but entire modules instead. This financial hurdle leads many claimants to attempt fraud.